The Ministry of Finance proposed raising the VAT rate to 22% from January 2026.

24 September 2025, 17:29 Economy

From January 1, 2026, the Russian Ministry of Finance proposes to raise the value-added tax (VAT) rate from 20% to 22%, as provided for in the budget package of bills. It is also planned to lower the income threshold for businesses on the simplified tax system (STS) from 60 to 10 million rubles. These measures are aimed at financing the country's defense capability. The corresponding amendments to the Tax Code have been submitted to the government.

The VAT increase should raise budget revenues, strengthen the financial system and reduce inflation. However, experts warn that this may become a challenge for small businesses.

Natalya Arsenyeva, a candidate of economic sciences, told the TV channel "360" that a gradual increase in VAT will lead to higher prices for goods and services. This will increase costs for small companies, complicate tax administration, and could reduce revenues. Businesses with low profit margins will be particularly affected.

However, a preferential 10% rate for socially significant goods and medicines will soften price increases for the basic consumer basket, the expert said.

The Finance Ministry proposes support measures: expedited VAT refunds, subsidies for digitization and accounting services, and access to concessional lending. These steps will help small companies cope with the increased tax burden, Arsentyeva added.

"Without such measures, the burden on small companies will be too high," she emphasized.

NIA "Nizhny Novgorod" has a Telegram channel. Subscribe to stay informed about the main events, exclusive materials and timely information.

Copyright © 1999–2025 NIA "Nizhny Novgorod". When reprinting, a hyperlink to NIA "Nizhny Novgorod" is required. This resource may contain 18+ material.

Другие Новости Нижнего (Н-Н-152)

The FSB uncovered a corruption scheme in the Nizhny Novgorod branch of the Ministry of Emergency Situations.

The FSB uncovered a corruption scheme in the Nizhny Novgorod branch of the Ministry of Emergency Situations.

The winners of the quest hosted by the fawn NiNo and the woodpecker Gor were awarded at the Nizhny Novgorod Kremlin.

The winners of the quest hosted by the fawn NiNo and the woodpecker Gor were awarded at the Nizhny Novgorod Kremlin.

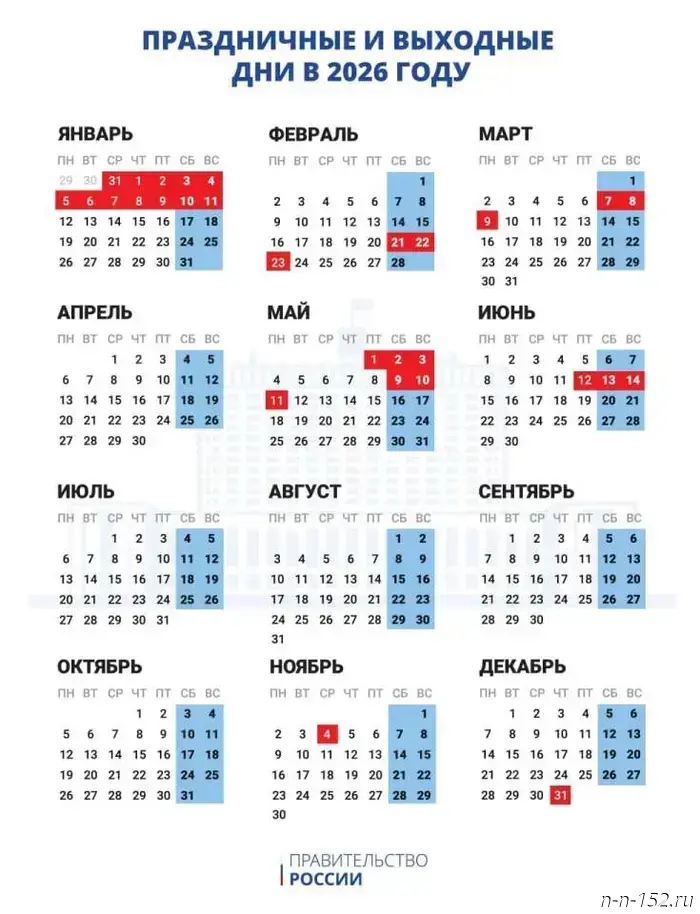

In Russia, the calendar of public holidays and days off for 2026 has been approved.

In Russia, the calendar of public holidays and days off for 2026 has been approved.

The new charter of Nizhny Novgorod will be considered at hearings on October 15.

The new charter of Nizhny Novgorod will be considered at hearings on October 15.

Nikitin and Sovetnikov planted an avenue of trees in Victory Park together with schoolchildren.

Nikitin and Sovetnikov planted an avenue of trees in Victory Park together with schoolchildren.

Municipal employees of Nizhny Novgorod will not receive a second pay raise within a year.

Municipal employees of Nizhny Novgorod will not receive a second pay raise within a year.