The financier explained how the new key interest rate will affect mortgages and loans.

July 25, 2025, 18:10

[127]

Economy

The Bank of Russia has lowered the key interest rate by 2 percentage points. This was announced following the Board of Directors meeting. Central Bank Governor Elvira Nabiullina stated that the rate reduction should be cautious, as inflation has not yet reached the target. She also noted that the decline in inflation might be temporary.

Financial market expert Andrey Barkota told the "360" channel that a 2 percentage point cut in the key rate will not make mortgages more affordable. In his opinion, the rate needs to be below 14% for that.

He also mentioned that a sufficient level of mortgage rates begins below 14%.

"When our mortgage rates fall below 14% — that means the key rate should be closer to 5%, and that will probably be at the end of 2026 or the beginning of 2027 — only then can we talk about mortgage affordability," the expert concluded.

Barkota also noted that loans will not become more accessible. According to business, affordable loans should be offered at 14% per annum or lower. He said the 2% rate reduction will only slightly decrease payments — by 3 to 10%. This is because businesses receive loans at a floating rate that depends on the key rate.

The expert also emphasized that the demand for loans remains low due to difficulties in meeting existing obligations. For those still wanting to take out a loan, Barkota advised approaching banks where the salary is deposited. Such banks have more information about the client's financial situation and can offer more favorable conditions.

The next Board of Directors meeting to set the key rate is scheduled for September 12. Analysts will monitor this event to assess the Central Bank’s next steps and their impact on the economy.

NI An "Nizhny Novgorod" has a Telegram channel. Subscribe to stay informed about major events, exclusive materials, and timely information.

Copyright © 1999–2025 NI An "Nizhny Novgorod". A hyperlink to NI An "Nizhny Novgorod" is required when reproducing. This resource may contain 18+ material.

Другие Новости Нижнего (Н-Н-152)

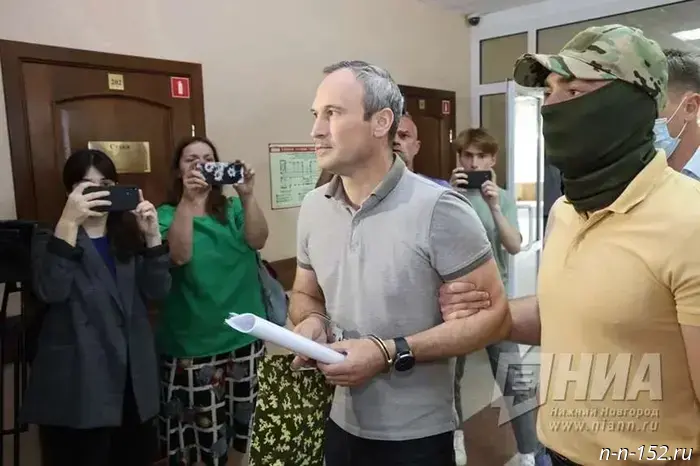

Nizhny Novgorod resident sentenced to 14 years in prison for treason

Residents of the Nizhny Novgorod region and Tver are found guilty of treason in favor of Ukraine. 25.07.2025. Nizhny Now. Nizhny Novgorod region. Nizhny Novgorod.

Nizhny Novgorod resident sentenced to 14 years in prison for treason

Residents of the Nizhny Novgorod region and Tver are found guilty of treason in favor of Ukraine. 25.07.2025. Nizhny Now. Nizhny Novgorod region. Nizhny Novgorod.

VTB: a slight cut in the key rate will somewhat "revive" retail lending

News of Nizhny Novgorod

VTB: a slight cut in the key rate will somewhat "revive" retail lending

News of Nizhny Novgorod

Nizhny Novgorod parliamentarians inspected the work of the forest fire services at Bor.

News of Nizhny Novgorod

Nizhny Novgorod parliamentarians inspected the work of the forest fire services at Bor.

News of Nizhny Novgorod

Bogdan Konyushkov remains at Nizhny Novgorod's "Torpedo" for another two years.

News of Nizhny Novgorod

Bogdan Konyushkov remains at Nizhny Novgorod's "Torpedo" for another two years.

News of Nizhny Novgorod

The Nizhny Novgorod court extended Halturin's detention for another two months.

News of Nizhny Novgorod

The Nizhny Novgorod court extended Halturin's detention for another two months.

News of Nizhny Novgorod

Unknown individuals created a fake video featuring Gleb Nikitin.

Video generated using neural network

Unknown individuals created a fake video featuring Gleb Nikitin. 25.07.2025. Komsomolskaya Pravda. Nizhny Novgorod Region. Nizhny Novgorod.

Unknown individuals created a fake video featuring Gleb Nikitin.

Video generated using neural network

Unknown individuals created a fake video featuring Gleb Nikitin. 25.07.2025. Komsomolskaya Pravda. Nizhny Novgorod Region. Nizhny Novgorod.

The financier explained how the new key interest rate will affect mortgages and loans.

News of Nizhny Novgorod