VTB: mortgage lending in Russia rose by 11% in September.

02 October 2025 10:52 Economy. According to preliminary estimates by VTB, in September Russian banks issued about 405 billion rubles in mortgage loans for the purchase of new and resale housing. This is 11% more than in September last year and 3% more than in August this year.

Against the backdrop of a falling key rate and improving market mortgage conditions at the largest banks, the share of state support continues to gradually decline. In September, according to VTB’s calculations, preferential programs accounted for 76% of total lending, compared with 78% in August and a peak of 82% in July. The market’s locomotive remains the “family” mortgage. VTB experts expect the share of state programs in the market to gradually fall to 70% by the end of the year.

In total, for the nine months of the year, mortgage lending in Russia, according to VTB estimates, amounted to more than 2.6 trillion rubles. That is roughly one-third lower than the result for January–September last year.

“The mortgage market is showing a slow but steady recovery. As the key rate falls, demand for secondary housing is reviving, and the segment is beginning to rebalance: the reduction in the share of state programs is being offset by a growing variety of market offerings,” commented Alexey Okhorzin, Senior Vice President, Head of the Retail Business Products Department at VTB.

NIA "Nizhny Novgorod" has a Telegram channel. Subscribe to stay informed about the main events, exclusive materials, and up-to-date information. Copyright © 1999—2025 NIA "Nizhny Novgorod". When reprinting, a hyperlink to NIA "Nizhny Novgorod" is required. This resource may contain 18+ materials.

Другие Новости Нижнего (Н-Н-152)

High-rise apartment buildings and social facilities will be built on Akademicheskaya Street in Nizhny Novgorod.

Nizhny Novgorod News

High-rise apartment buildings and social facilities will be built on Akademicheskaya Street in Nizhny Novgorod.

Nizhny Novgorod News

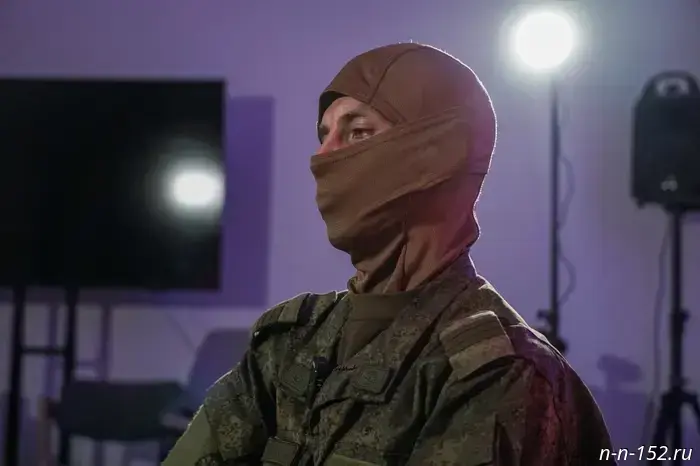

Participant in the special military operation: "We will liberate Russian lands and stop the enemy"

A sergeant with the callsign "Tyorkin" returned home after taking part in a special military operation, where he served as a sapper in a demining group for about ten months. October 2, 2025. NTA-Privolzhye. Nizhny Novgorod Oblast. Nizhny Novgorod.

Participant in the special military operation: "We will liberate Russian lands and stop the enemy"

A sergeant with the callsign "Tyorkin" returned home after taking part in a special military operation, where he served as a sapper in a demining group for about ten months. October 2, 2025. NTA-Privolzhye. Nizhny Novgorod Oblast. Nizhny Novgorod.

The leader of technological development among telecom operators in Russia has been named.

The Russian analytical agency J’son & Partners Consulting presented a ranking of the technological development of the largest telecommunications operators. 02.10.2025. NIA Nizhny Novgorod. Nizhny Novgorod Region. Nizhny Novgorod.

The leader of technological development among telecom operators in Russia has been named.

The Russian analytical agency J’son & Partners Consulting presented a ranking of the technological development of the largest telecommunications operators. 02.10.2025. NIA Nizhny Novgorod. Nizhny Novgorod Region. Nizhny Novgorod.

Blind participants of the "Drivers of Digital Inclusion" project from 21 regions of the Russian Federation began training as website testers in Nizhny Novgorod Oblast.

The "Drivers of Digital Inclusion" project has been launched in the Nizhny Novgorod Region. Lobachevsky University will train blind website accessibility testers for all of Russia. October 2, 2025. Government of the Nizhny Novgorod Region. Nizhny Novgorod Region. Nizhny Novgorod.

Blind participants of the "Drivers of Digital Inclusion" project from 21 regions of the Russian Federation began training as website testers in Nizhny Novgorod Oblast.

The "Drivers of Digital Inclusion" project has been launched in the Nizhny Novgorod Region. Lobachevsky University will train blind website accessibility testers for all of Russia. October 2, 2025. Government of the Nizhny Novgorod Region. Nizhny Novgorod Region. Nizhny Novgorod.

20 top homeroom teachers represented the Nizhny Novgorod Region at a specialized forum in Moscow.

The forum takes place as part of the Great Teachers' Week

20 of the best class teachers represent the Nizhny Novgorod Region at the 5th All-Russian Forum of Class Teachers, October 2, 2025. Znamya newspaper. Nizhny Novgorod Region. Bolshoye Murashkino.

20 top homeroom teachers represented the Nizhny Novgorod Region at a specialized forum in Moscow.

The forum takes place as part of the Great Teachers' Week

20 of the best class teachers represent the Nizhny Novgorod Region at the 5th All-Russian Forum of Class Teachers, October 2, 2025. Znamya newspaper. Nizhny Novgorod Region. Bolshoye Murashkino.

Viewers will see a TV series filmed in Nizhny Novgorod starring Alexander Petrov.

Nizhny Novgorod News

Viewers will see a TV series filmed in Nizhny Novgorod starring Alexander Petrov.

Nizhny Novgorod News

VTB: mortgage lending in Russia rose by 11% in September.

Nizhny Novgorod News