Russia's economy is returning to balanced growth rates - VTB

13 November 2025 18:06 Economy

After a period of rapid growth in 2023–2024, the Russian economy is showing a slowdown. The current reorientation of the economy is accompanied by a change of drivers and structural shifts, VTB management board member Vitaliy Sergeychuk said at the VTB investment forum “RUSSIA CALLS! Krasnodar.”

“You have to understand that the economy is not a 100‑metre dash but a marathon, and here it is important to measure your capabilities and resources over the long distance. Of course, for a year, two, three you can jump above your growth and show high growth rates for the economy. In the current years balanced growth is 1.5% GDP growth, to which we are carefully returning,” he emphasized.

According to VTB estimates, GDP growth in the third quarter was already zero compared with the previous quarter on a seasonally adjusted basis. Sectoral dynamics are uneven: retail and sectors oriented to domestic demand show positive dynamics, while export‑oriented and extractive industries, as well as related transport, are showing declines. Another source of tension has been record‑low unemployment, approaching 2%.

The current period of high rates, Sergeychuk said, is caused by domestic factors, not external shocks. “The stimulus that pushed the rate higher was the rise in budget spending, the growth of loan portfolios related to the restructuring of the economy, with companies increasing investment in that very restructuring and reorientation to the East,” he explained. At the same time, conservative fiscal policy and a tightening tax regime create conditions for future monetary policy easing.

It is expected that a combination of regulator measures, including mandatory currency purchases under the mirroring scheme, will put pressure on the ruble. VTB analysts do not rule out that the exchange rate could approach 100 rubles to the dollar by the end of next year. A reduction in the key rate will stimulate investment activity. VTB forecasts the rate at 13% by the end of next year, Vitaliy Sergeychuk said.

“If we talk about next year, it should be noted that we have a super‑conservative budget, and this will allow the central bank to eventually cut the rate more briskly. The tax changes last year and the VAT increase next year will allow for a more structurally balanced budget, and this will have much less impact on the money supply and on those internal causes of inflation growth that occurred in previous years. Again, we expect further reductions in the key rate and a more active investment strategy or policy from our companies,” the VTB representative concluded.

NIA “Nizhny Novgorod” has a Telegram channel. Subscribe to stay informed of the main events, exclusive materials and operational information. Copyright © 1999—2025 NIA “Nizhny Novgorod”. When reprinting, a hyperlink to NIA “Nizhny Novgorod” is mandatory. This resource may contain 18+ materials.

Другие Новости Нижнего (Н-Н-152)

At a meeting of the State Council commission, staffing for tech leadership projects was discussed.

At a meeting of the State Council commission, staffing for tech leadership projects was discussed.

The first Faculty of Economics Day was held at the NRU Presidential Academy.

Five companies from Nizhny Novgorod are participating in the "Chemistry-2025" exhibition on preferential terms.

Five enterprises from Nizhny Novgorod Oblast are participating on preferential terms in the 28th International Exhibition of Chemical Industry and Science "Chemistry-2025", which is taking place from November 10 to 13, 2025, in Moscow. November 13, 2025. Vadsky Municipal District. Nizhny Novgorod Oblast. Vad.

The first Faculty of Economics Day was held at the NRU Presidential Academy.

Five companies from Nizhny Novgorod are participating in the "Chemistry-2025" exhibition on preferential terms.

Five enterprises from Nizhny Novgorod Oblast are participating on preferential terms in the 28th International Exhibition of Chemical Industry and Science "Chemistry-2025", which is taking place from November 10 to 13, 2025, in Moscow. November 13, 2025. Vadsky Municipal District. Nizhny Novgorod Oblast. Vad.

T Plus's power plants and heating networks in the Nizhny Novgorod Region are ready to operate during the winter period.

T Plus's power plants and heating networks in the Nizhny Novgorod Region are ready to operate during the winter period.

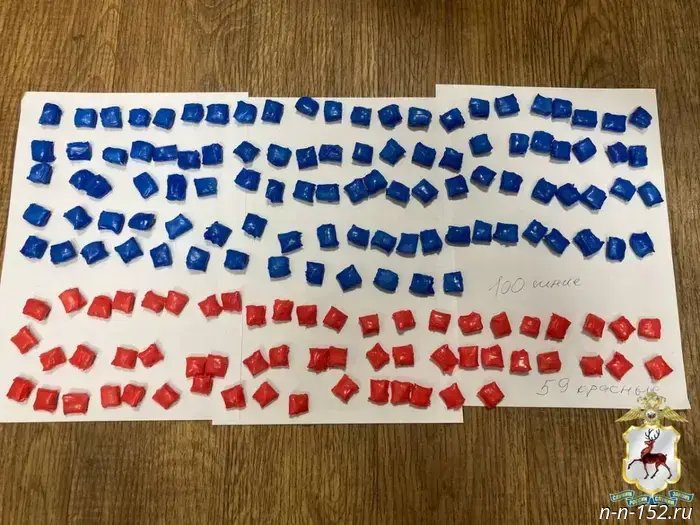

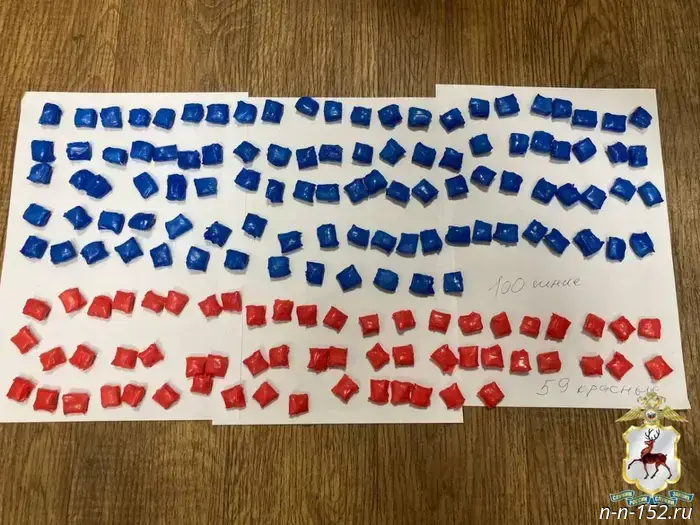

159 packets of drugs found on a stash runner in Nizhny Novgorod

34 million rubles of wage arrears were paid to Nizhny Novgorod residents for October.

The State Labor Inspectorate of the Nizhny Novgorod Region helped restore the labor rights of more than 600 workers in October. November 13, 2025. Online publication "We Live in Nizhny." Nizhny Novgorod Region. Nizhny Novgorod.

159 packets of drugs found on a stash runner in Nizhny Novgorod

34 million rubles of wage arrears were paid to Nizhny Novgorod residents for October.

The State Labor Inspectorate of the Nizhny Novgorod Region helped restore the labor rights of more than 600 workers in October. November 13, 2025. Online publication "We Live in Nizhny." Nizhny Novgorod Region. Nizhny Novgorod.