Nizhny Novgorod residents have taken out loans totaling 309.8 billion rubles since the beginning of the year.

11 November 2025 14:36 Economics

Residents of the Nizhny Novgorod region continue to save more actively than they borrow. After nine months of 2025, the volume of deposits in the region's banks (excluding escrow accounts) rose 10.9% since the start of the year and reached almost 1.2 trillion rubles. Compared with the same date last year, the increase was 19.7%.

According to the press service of the Volga‑Vyatka Main Directorate of the Bank of Russia, almost the entire amount of savings is in ruble deposits — 97.1%, or just over 1.1 trillion rubles.

Against this backdrop, the pace of retail lending has fallen noticeably. From January through September 2025 banks issued 309.8 billion rubles to residents of the region, which is 25.3% less than in the same period of 2024. Of these, 266.8 billion rubles were consumer loans and another 43 billion rubles were mortgages.

The total volume of credit obligations of Nizhny Novgorod residents as of October 1 amounted to 608.7 billion rubles. This is 0.5% more than at the beginning of the year, but 4.2% less than a year ago. The bulk of the debt consists of mortgage loans — 311.9 billion rubles. Consumer loans account for 296.8 billion rubles.

Experts attribute this dynamic to the high key rate set by the Bank of Russia. It makes loans less accessible due to rising interest rates, but at the same time makes deposit terms more attractive.

It was previously reported that Nizhny Novgorod residents spend on average 56.9% of their income on monthly mortgage payments.

NIA "Nizhny Novgorod" has a Telegram channel. Subscribe to stay informed about the main events, exclusive materials and timely information.

Copyright © 1999–2025 NIA "Nizhny Novgorod". When reprinting, a hyperlink to NIA "Nizhny Novgorod" is mandatory. This resource may contain materials for ages 18+.

Другие Новости Нижнего (Н-Н-152)

11 ноября 2025 года, 14:08 Экономика. В проект бюджета Нижнего Новгорода на 2025 год и перспективный план на 2026–2027 годы предлагается внести изменения, касающиеся финансирования строительства тоннеля в районе Почаинского оврага. Об этом сообщил директор департамента финансов администрации города Юрий Мочалкин на заседании совместной комиссии городской думы по бюджетной, финансовой, налоговой политике и городскому хозяйству, передаёт корреспондент НИА "Нижний Новгород".

Мочалкин отметил, что изменения основаны на гарантийных письмах от правительства Нижегородской области. В рамках софинансирования из областного бюджета планируется увеличить как доходную, так и расходную части городского бюджета через межбюджетные трансферты.

В частности, строительство тоннеля по адресу улица Архитектора Харитонова, дом № 1а получит дополнительное финансирование: в 2025 году — 40 миллионов рублей, в 2026 году — 59,9 миллиона рублей, а в 2027 году — 63,2 миллиона рублей. Доля софинансирования со стороны города составит 0,1%.

Общий объём средств, предусмотренных на реализацию проекта за три года, превысит 163 миллиона рублей. Депутат Мария Кузнецова задала вопрос о том, совпадают ли сроки строительства со сроками финансирования. Директор департамента строительства и капитального ремонта Татьяна Гераськина подтвердила, что это так, отметив, что в этом году будет заключён контракт, а срок завершения работ запланирован на 2027 год.

Напомним, что стометровый тоннель соединит обе части оврага под Лыковой дамбой. Работы ведутся в рамках создания террасного парка, строительство которого началось в конце 2023 года. Исходно планировалось завершить работы к ноябрю 2025 года, но в октябре власти сообщили о необходимости корректировки сроков.

Также сообщалось, что на строительство террасного парка в Почаинском овраге дополнительно будет направлено 111,5 миллиона рублей из собственных средств города. У НИА "Нижний Новгород" есть Telegram-канал. Подписывайтесь, чтобы быть в курсе основных событий, эксклюзивных материалов и оперативной информации. Copyright © 1999—2025 НИА "Нижний Новгород". При перепечатке гиперссылка на НИА "Нижний Новгород" обязательна. Данный ресурс может содержать материалы 18+.

11 ноября 2025 года, 14:08 Экономика. В проект бюджета Нижнего Новгорода на 2025 год и перспективный план на 2026–2027 годы предлагается внести изменения, касающиеся финансирования строительства тоннеля в районе Почаинского оврага. Об этом сообщил директор департамента финансов администрации города Юрий Мочалкин на заседании совместной комиссии городской думы по бюджетной, финансовой, налоговой политике и городскому хозяйству, передаёт корреспондент НИА "Нижний Новгород".

Мочалкин отметил, что изменения основаны на гарантийных письмах от правительства Нижегородской области. В рамках софинансирования из областного бюджета планируется увеличить как доходную, так и расходную части городского бюджета через межбюджетные трансферты.

В частности, строительство тоннеля по адресу улица Архитектора Харитонова, дом № 1а получит дополнительное финансирование: в 2025 году — 40 миллионов рублей, в 2026 году — 59,9 миллиона рублей, а в 2027 году — 63,2 миллиона рублей. Доля софинансирования со стороны города составит 0,1%.

Общий объём средств, предусмотренных на реализацию проекта за три года, превысит 163 миллиона рублей. Депутат Мария Кузнецова задала вопрос о том, совпадают ли сроки строительства со сроками финансирования. Директор департамента строительства и капитального ремонта Татьяна Гераськина подтвердила, что это так, отметив, что в этом году будет заключён контракт, а срок завершения работ запланирован на 2027 год.

Напомним, что стометровый тоннель соединит обе части оврага под Лыковой дамбой. Работы ведутся в рамках создания террасного парка, строительство которого началось в конце 2023 года. Исходно планировалось завершить работы к ноябрю 2025 года, но в октябре власти сообщили о необходимости корректировки сроков.

Также сообщалось, что на строительство террасного парка в Почаинском овраге дополнительно будет направлено 111,5 миллиона рублей из собственных средств города. У НИА "Нижний Новгород" есть Telegram-канал. Подписывайтесь, чтобы быть в курсе основных событий, эксклюзивных материалов и оперативной информации. Copyright © 1999—2025 НИА "Нижний Новгород". При перепечатке гиперссылка на НИА "Нижний Новгород" обязательна. Данный ресурс может содержать материалы 18+.

После миграционных рейдов из Нижегородской области было выдворено 203 иностранных граждан.

Общее количество нарушений миграционного законодательства составило 965.

После миграционных рейдов из Нижегородской области было выдворено 203 иностранца. 11.11.2025. Комсомольская Правда. Нижегородская область. Нижний Новгород.

После миграционных рейдов из Нижегородской области было выдворено 203 иностранных граждан.

Общее количество нарушений миграционного законодательства составило 965.

После миграционных рейдов из Нижегородской области было выдворено 203 иностранца. 11.11.2025. Комсомольская Правда. Нижегородская область. Нижний Новгород.

Дополнительно 163 миллиона рублей направят на возведение тоннеля в Почаинском овраге.

Добровольцы из разных регионов приступили к подготовке к службе в СВО.

Команда добровольцев прошла медицинское обследование и подписала контракты в нижегородском центре отбора перед началом боевой подготовки для участия в специальной военной операции. 11.11.2025. НТА-Приволжье. Нижегородская область. Нижний Новгород.

Дополнительно 163 миллиона рублей направят на возведение тоннеля в Почаинском овраге.

Добровольцы из разных регионов приступили к подготовке к службе в СВО.

Команда добровольцев прошла медицинское обследование и подписала контракты в нижегородском центре отбора перед началом боевой подготовки для участия в специальной военной операции. 11.11.2025. НТА-Приволжье. Нижегородская область. Нижний Новгород.

На улице Ульянова в Нижнем Новгороде будет построен четырехэтажный медицинский центр.

На улице Ульянова в Нижнем Новгороде будет построен четырехэтажный медицинский центр.

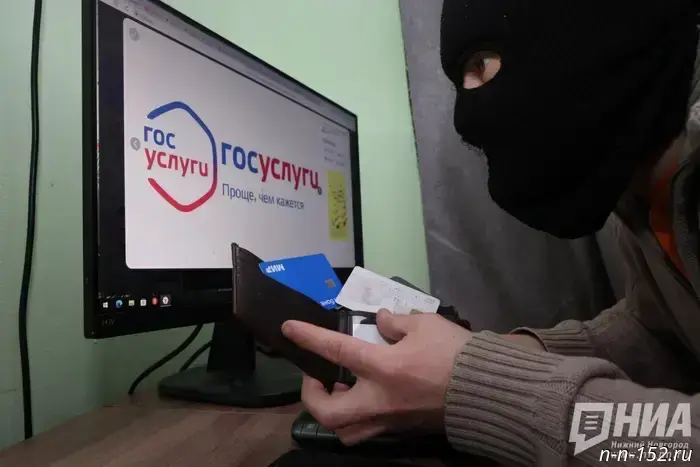

Нижегородца наказали штрафом за взлом портала "Госуслуги" и передачу чужих данных.

Нижегородца наказали штрафом за взлом портала "Госуслуги" и передачу чужих данных.